by Charley Martinez, Farm Management Specialist

February 27, 2026

Overview

Corn, Soybeans, Cotton, and Wheat up for the week

This week brought some mid-week volatility in the futures. Spot prices remained stronger to steady, and both the futures and the board ended up for the week. Massive week-to-week gains occurred in the wheat markets, with board prices going over $6 for the first time in a long time. Beans continued to push higher on the week, with some mid-week scares. Futures contracts are giving some opportunity to lock in great margins across all commodities. I would really suggest locking in these prices, even if partially, to provide some downside security.

This week, the USDA released their Agricultural Prices report. At 89.8, the Crop Production Index was down 6.7% from last month but up 0.9% from the previous year. Looking at various national prices, Tennessee received well above national averages. For corn, prices received in Tennessee were $4.71, which is 2 cents higher than January 2025. For soybeans, prices received in Tennessee were $10.7, which is 20 cents higher than January 2025. Given board movements and recent spot prices, I would expect next months report to have higher prices.

| Indicator | Previous | Current | Change |

|---|---|---|---|

| USD Index | 97.80 | 97.64 | -0.16 |

| Crude Oil | 66.41 | 67.23 | 0.82 |

| DJIA | 49515 | 48978 | -537 |

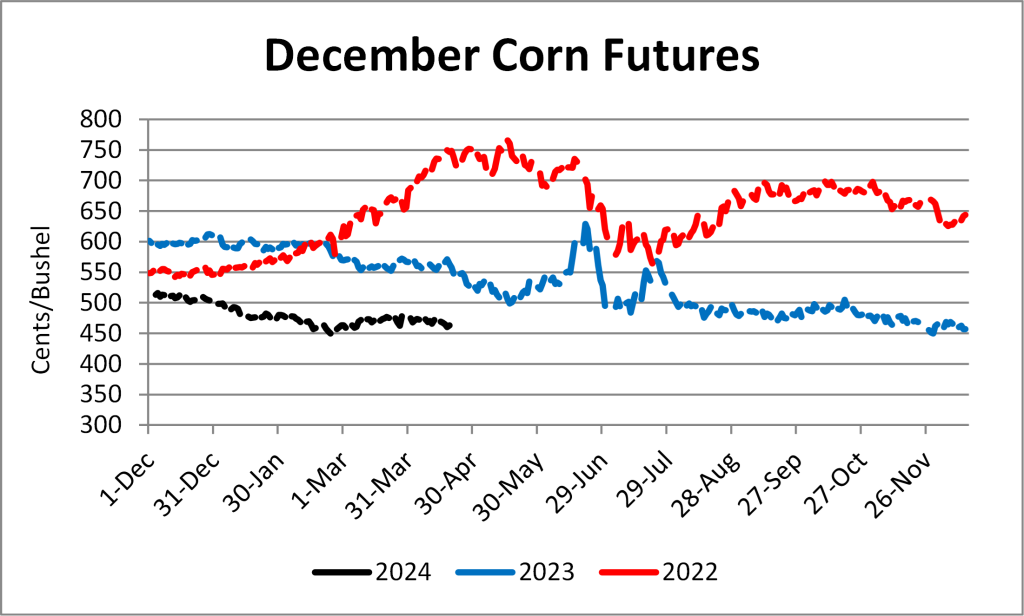

Corn

Across Tennessee, average corn basis (cash price-nearby futures price) strengthened from last week at West, Northwest, West-Central, North-Central, and Mississippi River elevators and barge points. Overall, basis for the week ranged from 15 cents under to 37 cents over, with an average of 16 cents over with the March futures at elevators and barge points. Ethanol production for the week ending February 20th was 1.115 million barrels, down 5,000 barrels compared to the previous week. Ethanol stocks were 25.646 million barrels, up 58,000 barrels compared to the previous week. Cash prices ranged from $4.13 to $4.77 at elevators and barge points. On Friday, March 2026 corn futures closed at $4.38, which is up 11 cents compared to last week. For the week, March 2026 corn futures traded between $4.25 and $4.40.

| Corn | Mar 26 | Change | Sep 26 | Change |

|---|---|---|---|---|

| Price | $4.38 | $0.11 | $4.55 | $0.06 |

| Support | $4.33 | $0.09 | $4.55 | $0.08 |

| Resistance | $4.41 | $0.12 | $4.57 | $0.06 |

| 20 Day MA | $4.29 | $0.01 | $4.46 | $0.02 |

| 50 Day MA | $4.33 | -$0.01 | $4.46 | $0.00 |

| 100 Day MA | $4.37 | -$0.01 | $4.49 | $0.00 |

| 4-Week High | $4.40 | $0.04 | $4.56 | $0.06 |

| 4-Week Low | $4.24 | $0.03 | $4.38 | $0.03 |

| Technical Trend | UP | = | UP | = |

For the week February 13-19, 2026, there were net sales of 685,800 MT for 2025/2026, down 53% from the previous week, and 56% from the prior 4-week average. Exports of 1,967,400 MT, up 21% from the previous week and 32% from the prior 4-week average. This week new crop cash contracts ranged from $4.18 to $4.78 at elevators and barge points. September 2026 corn futures closed at $4.55, which is 6 cents higher compared to last week.

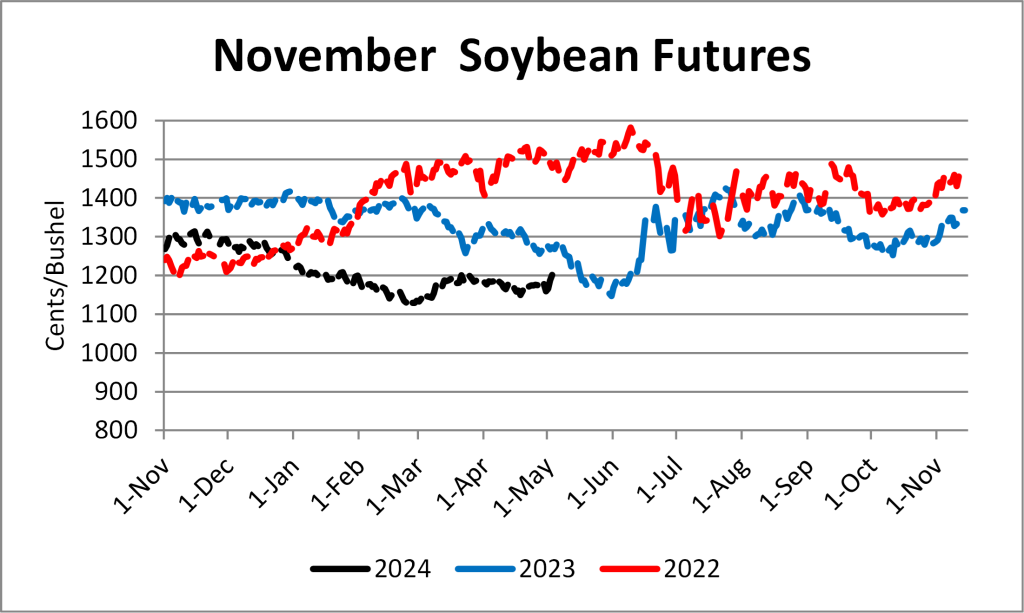

Soybeans

Across Tennessee average soybean basis strengthened compared to last week at West, Northwest, North-Central, West-Central, and Mississippi River elevators and barge points. Average basis ranged from 30 under to 55 over the March futures contract, with an average basis at the end of the week of 10.5 cents over. Cash soybean prices at elevators and barge points ranged from $11.04 to $12.03. September 2026 soybean futures closed at $11.32, up 13 cents compared to last week. For the week, September 2026 soybean futures traded between $11.12 and $11.36.

| Soybeans | Sep 26 | Change | Nov 26 | Change |

|---|---|---|---|---|

| Price | $11.32 | $0.13 | $11.28 | $0.13 |

| Support | $11.27 | $0.18 | $11.23 | $0.17 |

| Resistance | $11.36 | $0.09 | $11.32 | $0.11 |

| 20 Day MA | $11.08 | $0.12 | $11.07 | $0.10 |

| 50 Day MA | $10.84 | $0.04 | $10.87 | $0.03 |

| 100 Day MA | $10.90 | $0.03 | $10.91 | $0.03 |

| 4-Week High | $11.35 | $0.08 | $11.32 | $0.08 |

| 4-Week Low | $10.62 | $0.05 | $10.68 | $0.05 |

| Technical Trend | UP | = | UP | = |

For the week February 13-19, 2026, there were net sales of 407,100 MT for 2025/2026, down 49% from the previous week and 30% from the prior 4-week average. There was another week of activity increases by China. Exports of 811,500 MT, down 37% from the previous week and 36% from the prior 4-week average. The destinations were primarily to China (339,500 MT), Germany (127,000 MT), Mexico (91,900 MT), Japan (55,000 MT, including 1,100 MT – late), and Egypt (52,800 MT). November 2026 soybean futures closed at $11.28, up 13 cents compared to last week.

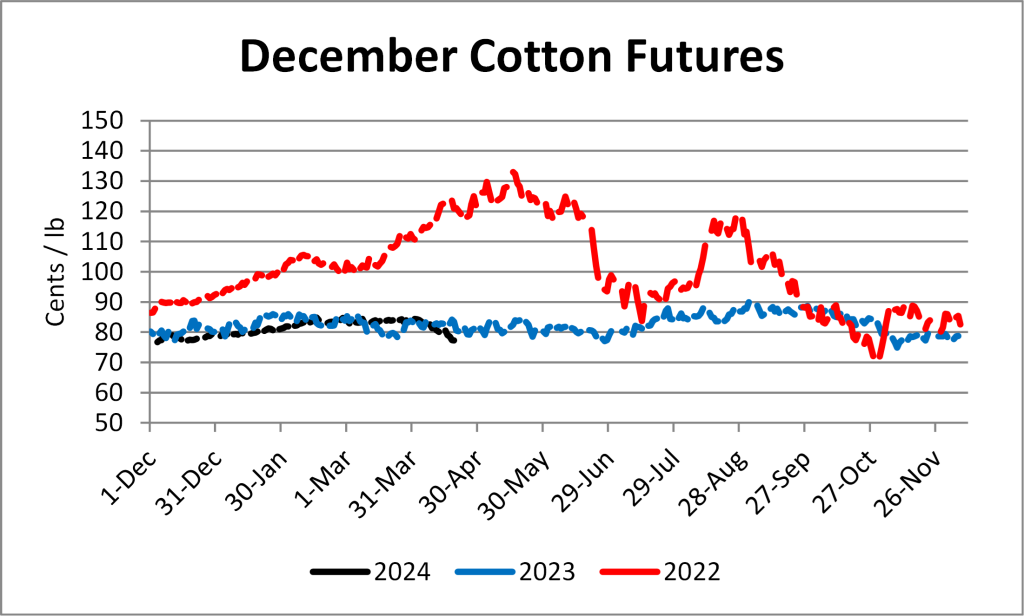

Cotton

North Delta upland cotton spot price quotes for February 27th were up compared to last week. Prices were up to 63.36 cents/lb (41-4-34), and 68.11 cents/lb (31-3-35), which made both up 1.22 cents compared to last week prices (up 3.07 cents over the last two weeks).

| Cotton | Mar 26 | Change | May 26 | Change |

|---|---|---|---|---|

| Price | 63.61 | 0.58 | 65.61 | -0.02 |

| Support | 63.61 | 1.42 | 65.18 | 0.56 |

| Resistance | 63.61 | -0.02 | 65.91 | -0.27 |

| 20 Day MA | 62.45 | 0.02 | 64.45 | 0.07 |

| 50 Day MA | 63.48 | -0.03 | 65.14 | 0.06 |

| 100 Day MA | 64.33 | -0.18 | 65.75 | -0.16 |

| 4-Week High | 64.80 | 0.13 | 66.38 | -0.34 |

| 4-Week Low | 60.90 | 0.00 | 62.86 | 0.00 |

| Technical Trend | UP | = | UP | = |

For the week February 13-19, 2026, there was a total net sales of Upland totaling 253,200 RB for 2025/2026, down 46% from the previous week and 12% from the prior 4-week average. Exports of 193,000 RB were up 12% from the previous week, but down 10% from the prior 4-week average. For the week, March 2026 cotton futures closed at 63.61 on Friday, which is .58 cents compared to last week. It traded between 62.67-64.31 cents. May 2026 cotton futures closed at 65.61 cents, down .02 cents compared to last week. December 2026 cotton futures closed at 69.7 cents, up .4 cents compared to last week.

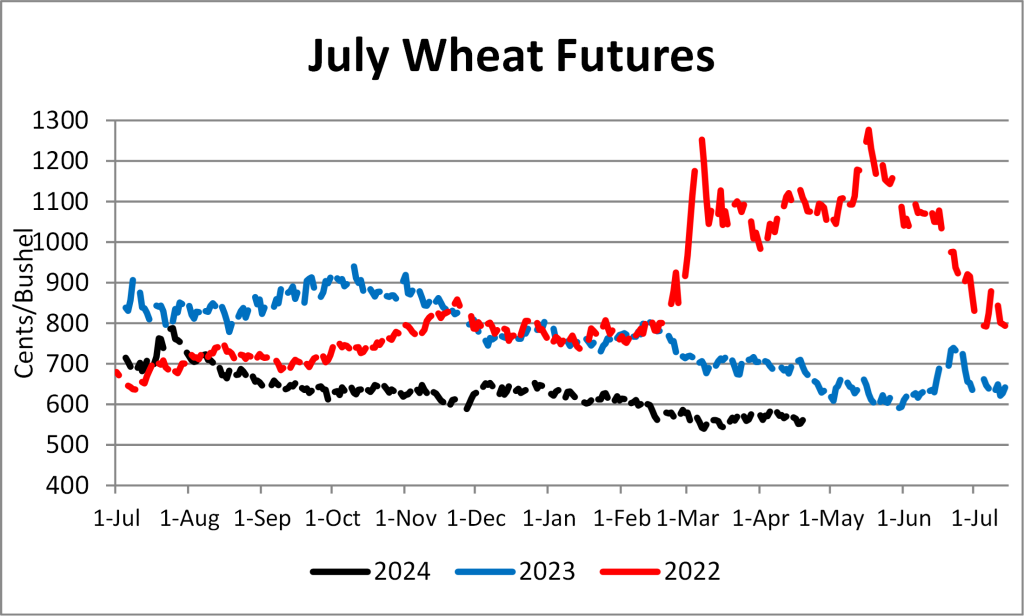

Wheat

Wheat cash prices at elevators and barge points ranged from $5.46 to $5.52.

| Wheat | Jul 26 | Change | Sep 26 | Change |

|---|---|---|---|---|

| Price | $5.99 | $0.12 | $6.09 | $0.11 |

| Support | $5.85 | $0.12 | $5.96 | $0.09 |

| Resistance | $6.07 | $0.14 | $6.18 | $0.14 |

| 20 Day MA | $5.63 | $0.08 | $5.75 | $0.08 |

| 50 Day MA | $5.48 | $0.08 | $5.61 | $0.04 |

| 100 Day MA | $5.52 | $0.01 | $5.65 | $0.01 |

| 4-Week High | $6.03 | $0.14 | $6.13 | $0.14 |

| 4-Week Low | $5.42 | $0.11 | $5.55 | $0.10 |

| Technical Trend | UP | = | UP | = |

For the week February 13-19, 2026, there was a total net sales of 243,000 metric tons (MT) for 2025/2026, down 16% from the previous week and 43% from the prior 4-week average. Exports of 540,000 MT, up 67% from the previous week and 28% from the prior 4-week average. July 2026 wheat futures closed at $5.99, up 12 cents compared to last week. July 2026 wheat futures traded between $5.73 and $6.03 this week. September 2026 wheat futures closed at $6.09, up 11 cents compared to last week.

Additional Information

Links for data presented:

U.S. Export Sales – https://apps.fas.usda.gov/export-sales/esrd1.html

USDA FAS: Weekly Export Performance Indicator – https://apps.fas.usda.gov/esrquery/esrpi.aspx

EIA: Weekly ethanol Plant Production – https://www.eia.gov/dnav/pet/pet_pnp_wprode_s1_w.htm

EIA: Weekly Supply Estimates – https://www.eia.gov/dnav/pet/pet_sum_sndw_a_EPOOXE_sae_mbbl_w.htm

Upland Cotton Reports – https://www.fsa.usda.gov/FSA/epasReports?area=home&subject=ecpa&topic=fta-uc

Tennessee Crop Progress – https://www.nass.usda.gov/Statistics_by_State/Tennessee/Publications/Crop_Progress_&_Condition/

U.S. Crop Progress – http://usda.mannlib.cornell.edu/MannUsda/viewDocumentInfo.do?documentID=1048

USDA AMS: Market News – https://www.ams.usda.gov/market-news/search-market-news

If you would like further information or clarification on topics discussed in the crop comments section or would like to be added to our free email list please contact me at cmart113@utk.edu.