by Charley Martinez, Farm Management Specialist

January 9, 2026

Overview

Corn, Soybeans, Cotton, and Wheat up for the week

I hope everyone had a great break. A lot has occurred since the last notes on December 19, 2025. Trade data is back to being up to date. The comments this week include the most recent trade data.

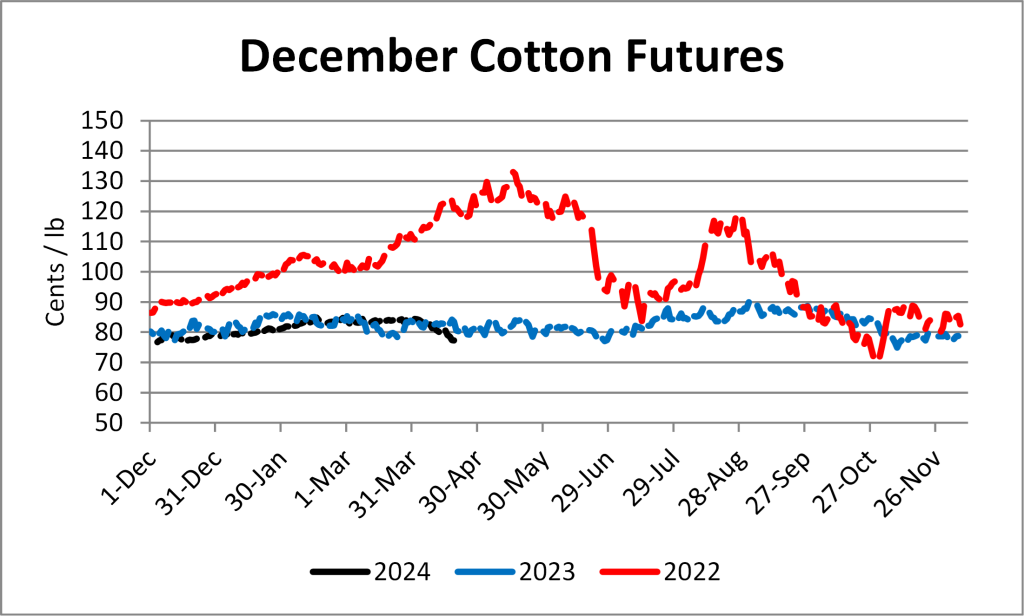

Prices this week are compared to the last round of notes (December 19, 2025). The biggest change in prices was seen in the cotton market, where prices trended up through the end of December and the first part of January. This is interesting for a couple of reasons. The first is that the market had trended downward basically the last two months of 2025. In December, the market got USDA cotton production data, and the market was lower on that day (I commented about it in the December 19th notes). Since then, prices have trended upward, which signals to me that the market possibly does not agree with the supply estimate in the December estimate, and the market believes that its lower. Next week we will get production data and we will see if there is any adjustments to estimates. I think it’s important to remember that last month’s estimates were coming off the heels of the government shutdown.

On December 31, 2025, the USDA announced the payment rates for the FBA program. Below is a table with estimates of total payouts for each commodity that was eligible in Tennessee. It is important to note that there is a $155,000 maximum payment per individual or legal entity (corporations, LLCs, trusts), and an average Adjusted Gross Income (AGI) limit of $900,000.

2025 PLANTED ACRES (INCLUDING FAILED ACRES) REPORTED TO FARM SERVICE AGENCY – December 9 data

| BARLEY | CORN | COTTON | OATS | RICE | SORGHUM | SOYBEANS | WHEAT | Grand Total | |

|---|---|---|---|---|---|---|---|---|---|

| Tennessee Acres | 2,019 | 897,270 | 202,244 | 3,831 | 1,898 | 3,021 | 1,505,420 | 291,791 | 2,907,493 |

| FBA Rate Per Acre | 20.51 | 44.36 | 117.35 | 81.75 | 132.89 | 48.11 | 30.88 | 39.35 | |

| Total | $41,401 | $39,802,899 | $23,733,292 | $313,164 | $252,265 | $145,322 | $46,487,372 | $11,481,972 | $63,890,756 |

The grand total amount ($122,257,687) will likely not occur due to the limits, but this program will provide some support for producers.

| Indicator | Previous | Current | Change |

|---|---|---|---|

| USD Index | 98.72 | 99.12 | 0.40 |

| Crude Oil | 56.55 | 58.81 | 2.26 |

| DJIA | 48134 | 49514 | 1380 |

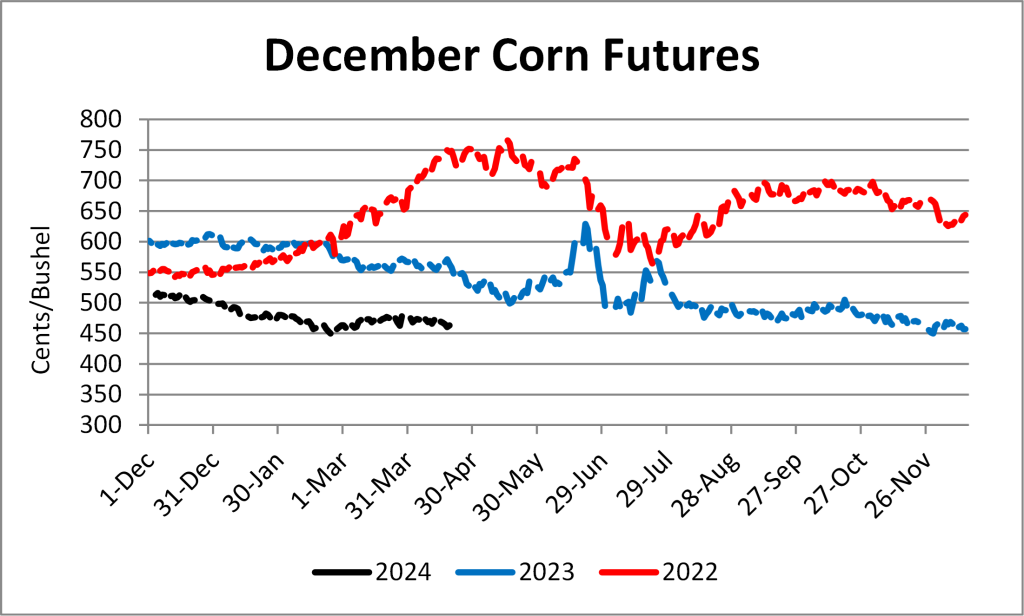

Corn

Across Tennessee, average corn basis (cash price-nearby futures price) strengthened from last week at West, Northwest, West-Central, North-Central, and Mississippi River elevators and barge points. Overall, basis for the week ranged from 19 cents under to 26 cents over, with an average of 11 cents over with the March futures at elevators and barge points. Ethanol production for the week ending January 2nd was 1.098 million barrels, down 22,000 barrels compared to the previous week. Ethanol stocks were 23.652 million barrels, up 708,000 barrels compared to last week. Cash prices ranged from $4.26 to $4.75 at elevators and barge points. On Friday, March 2026 corn futures closed at $4.45, which is up 2 cents compared to December 19, 2025. For the week, March 2026 corn futures traded between $4.36 and $4.48.

| Corn | Mar 26 | Change | Sep 26 | Change |

|---|---|---|---|---|

| Price | $4.45 | $0.02 | $4.53 | $0.02 |

| Support | $4.42 | $0.00 | $4.52 | $0.02 |

| Resistance | $4.47 | $0.03 | $4.54 | $0.03 |

| 20 Day MA | $4.43 | $0.00 | $4.51 | $0.00 |

| 50 Day MA | $4.44 | $0.02 | $4.53 | $0.02 |

| 100 Day MA | $4.40 | $0.03 | $4.51 | $0.02 |

| 4-Week High | $4.53 | $0.01 | $4.58 | -$0.01 |

| 4-Week Low | $4.35 | $0.01 | $4.45 | $0.00 |

| Technical Trend | UP | = | UP | = |

For the week December 26, 2025 – January 1, 2026, there was a total net sales of 377,600 MT for 2025/2026 (a marketing-year low), which was down 49% from the previous week and 76% from the prior 4-week average. This week new crop cash contracts ranged from $4.31 to $4.80 at elevators and barge points. Total net sales of 11,900 MT for 2026/2027 were for Mexico. Exports of 1,396,500 MT were unchanged from the previous week, but down 12% from the prior 4-week average. September 2026 corn futures closed at $4.53, up 3 cents compared to December 19, 2025. As we work our way through this year, any sign of prices being higher should be thought about in terms of locking in for a position.

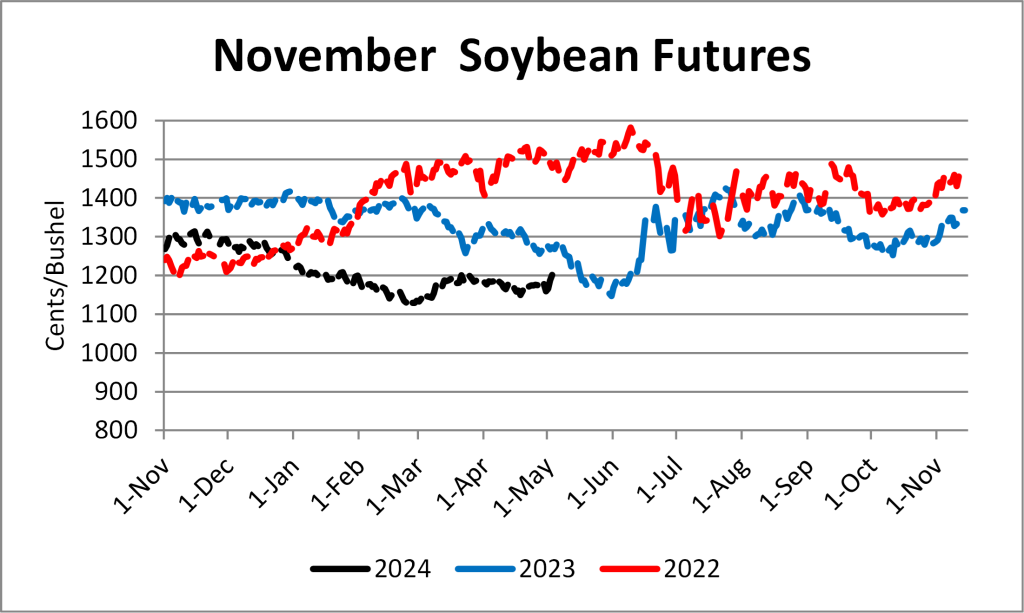

Soybeans

Across Tennessee average soybean basis remained relatively strengthened compared to last week at West, Northwest, North-Central, West-Central, and Mississippi River elevators and barge points. Average basis ranged from 25 under to 44 over the January futures contract, with an average basis at the end of the week of 19 cents over. Cash soybean prices at elevators and barge points ranged from $10.17 to $10.99. January 2026 soybean futures closed at $10.48, down 1 cent compared to December 19,2025. For the week, January 2026 soybean futures traded between $10.35 and $10.55.

| Soybeans | Jan 26 | Change | Sep 26 | Change |

|---|---|---|---|---|

| Price | $10.48 | -$0.01 | $10.68 | $0.05 |

| Support | $10.46 | $0.00 | $10.65 | $0.04 |

| Resistance | $10.51 | -$0.02 | $10.73 | $0.07 |

| 20 Day MA | $10.54 | -$0.44 | $10.71 | -$0.29 |

| 50 Day MA | $10.95 | $0.00 | $10.96 | $0.00 |

| 100 Day MA | $10.72 | $0.03 | $10.83 | $0.02 |

| 4-Week High | $10.96 | -$0.46 | $10.96 | -$0.34 |

| 4-Week Low | $10.22 | -$0.25 | $10.51 | -$0.11 |

| Technical Trend | DOWN | = | UP | = |

For the week December 26, 2025 – January 1, 2026, there was a total net sales of 877,900 MT for 2025/2026, down 26% from the previous week and 42% from the prior 4-week average. There was activity of increases for China. Exports of 1,112,600 MT were down 9% from the previous week, but up 17% from the prior 4-week average. The destinations were primarily to China (397,100 MT), Egypt (252,200 MT), Mexico (94,500 MT), Taiwan (84,900 MT), and Indonesia (72,600 MT). September 2026 soybean futures closed at $10.68, up 5 cents since December 19,2025.

Cotton

North Delta upland cotton spot price quotes for January 8th were mixed. Prices were 62.21 cents/lb (41-4-34), which is down .55 since last week, and 66.96 cents/lb (31-3-35), which was up .45 since last week.

| Cotton | Mar 26 | Change | May 26 | Change |

|---|---|---|---|---|

| Price | 64.41 | 0.66 | 65.91 | 1.07 |

| Support | 64.23 | 0.73 | 65.71 | 2.21 |

| Resistance | 64.93 | 0.99 | 66.12 | 2.18 |

| 20 Day MA | 64.11 | 0.10 | 65.36 | 1.35 |

| 50 Day MA | 64.58 | -0.34 | 65.78 | 0.86 |

| 100 Day MA | 66.07 | -0.55 | 67.33 | 0.71 |

| 4-Week High | 65.76 | 0.81 | 67.11 | 2.16 |

| 4-Week Low | 62.97 | 0.00 | 64.12 | 1.15 |

| Technical Trend | UP | = | UP | = |

For the week December 26, 2025 – January 1, 2026, there was a total net sales of Upland totaling 98,000 RB for 2025/2026, down 27% from the previous week and 49% from the prior 4-week average. Exports of 154,000 RB, up10% from the previous week, and 18% from the prior 4-week average. For the week, March 2026 cotton futures closed at 64.41on Friday, which is up.66 cents compared to December 19,2025. It traded between 64.24 to 64.91 cents. May 2026 cotton futures closed at 65.91cents, up 1.07 cents compared to December 19,2025. December 2026 cotton futures closed at 68.83cents, up 1.53 cents compared to December 19,2025.

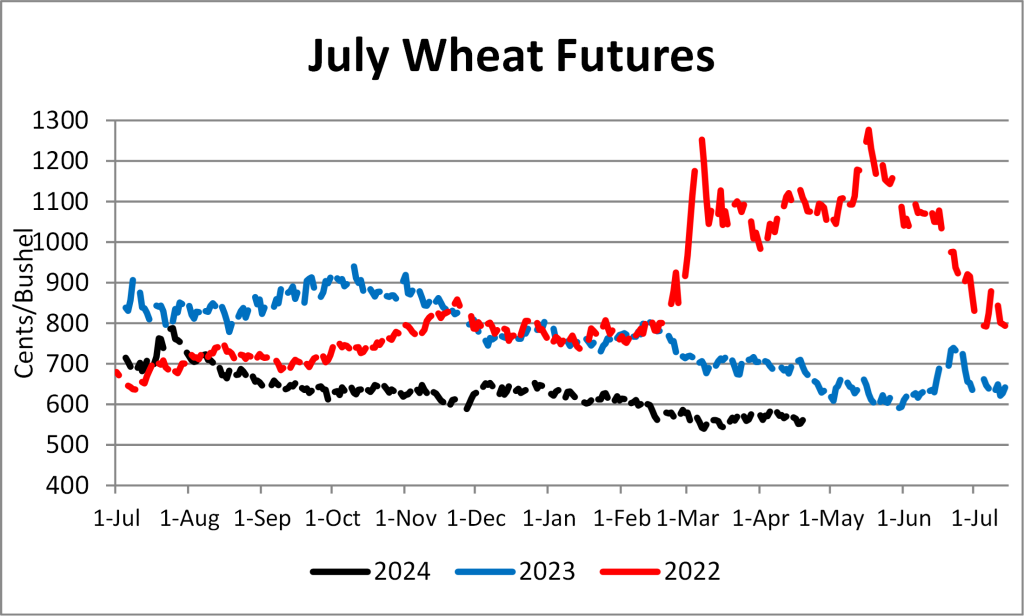

Wheat

Wheat cash prices at elevators and barge points ranged from $4.81 to $4.88.

| Wheat | Jul 26 | Change | Sep 26 | Change |

|---|---|---|---|---|

| Price | $5.40 | $0.09 | $5.54 | $0.09 |

| Support | $5.44 | $0.16 | $5.51 | $0.09 |

| Resistance | $5.37 | $0.03 | $5.57 | $0.10 |

| 20 Day MA | $5.36 | -$0.11 | $5.50 | -$0.09 |

| 50 Day MA | $5.52 | -$0.02 | $5.65 | -$0.02 |

| 100 Day MA | $5.54 | -$0.05 | $5.67 | -$0.05 |

| 4-Week High | $5.51 | -$0.20 | $5.62 | -$0.21 |

| 4-Week Low | $5.25 | -$0.01 | $5.39 | $0.00 |

| Technical Trend | UP | = | UP | = |

For the week December 26, 2025 – January 1, 2026, there was a total net sales of 118,700 metric tons (MT) for 2025/2026, up 24% from the previous week, but down 55% from the prior 4-week average. Exports of 172,000 MT were down 60% from the previous week and 65% from the prior 4-week average. July 2026 wheat futures closed at $5.40, up 9 cents compared to December 19,2025. July 2026 wheat futures traded between $5.30 and $5.44 this week. September 2026 wheat futures closed at $5.54, up 9 cents since December 19,2025.

Additional Information

Links for data presented:

U.S. Export Sales – https://apps.fas.usda.gov/export-sales/esrd1.html

USDA FAS: Weekly Export Performance Indicator – https://apps.fas.usda.gov/esrquery/esrpi.aspx

EIA: Weekly ethanol Plant Production – https://www.eia.gov/dnav/pet/pet_pnp_wprode_s1_w.htm

EIA: Weekly Supply Estimates – https://www.eia.gov/dnav/pet/pet_sum_sndw_a_EPOOXE_sae_mbbl_w.htm

Upland Cotton Reports – https://www.fsa.usda.gov/FSA/epasReports?area=home&subject=ecpa&topic=fta-uc

Tennessee Crop Progress – https://www.nass.usda.gov/Statistics_by_State/Tennessee/Publications/Crop_Progress_&_Condition/

U.S. Crop Progress – http://usda.mannlib.cornell.edu/MannUsda/viewDocumentInfo.do?documentID=1048

USDA AMS: Market News – https://www.ams.usda.gov/market-news/search-market-news

If you would like further information or clarification on topics discussed in the crop comments section or would like to be added to our free email list please contact me at cmart113@utk.edu.